straight life policy term

Ad View 2021s Top 5 Term Life Insurance Companies. Term life policies will also halt coverage if you stop making your premium payments.

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide.

. Issued in an amount not to exceed the amount of the loan. If you think you may want the benefits and growth of a straight life policy but are concerned about premium costs a convertible term policy might be right for you. Ad Our Comparison Chart Makes Choosing Simple.

Term life insurance policies are only good for a specific set of years usually 15 20 or 30 depending on the policy. After death however the payments cease and the. The Cash Value equals the death.

Apply 100 Online In Minutes. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Term Ticket Model.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. February 27 2022. Term Life Insurance.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A life insurance policy that provides coverage only for a certain period of time. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

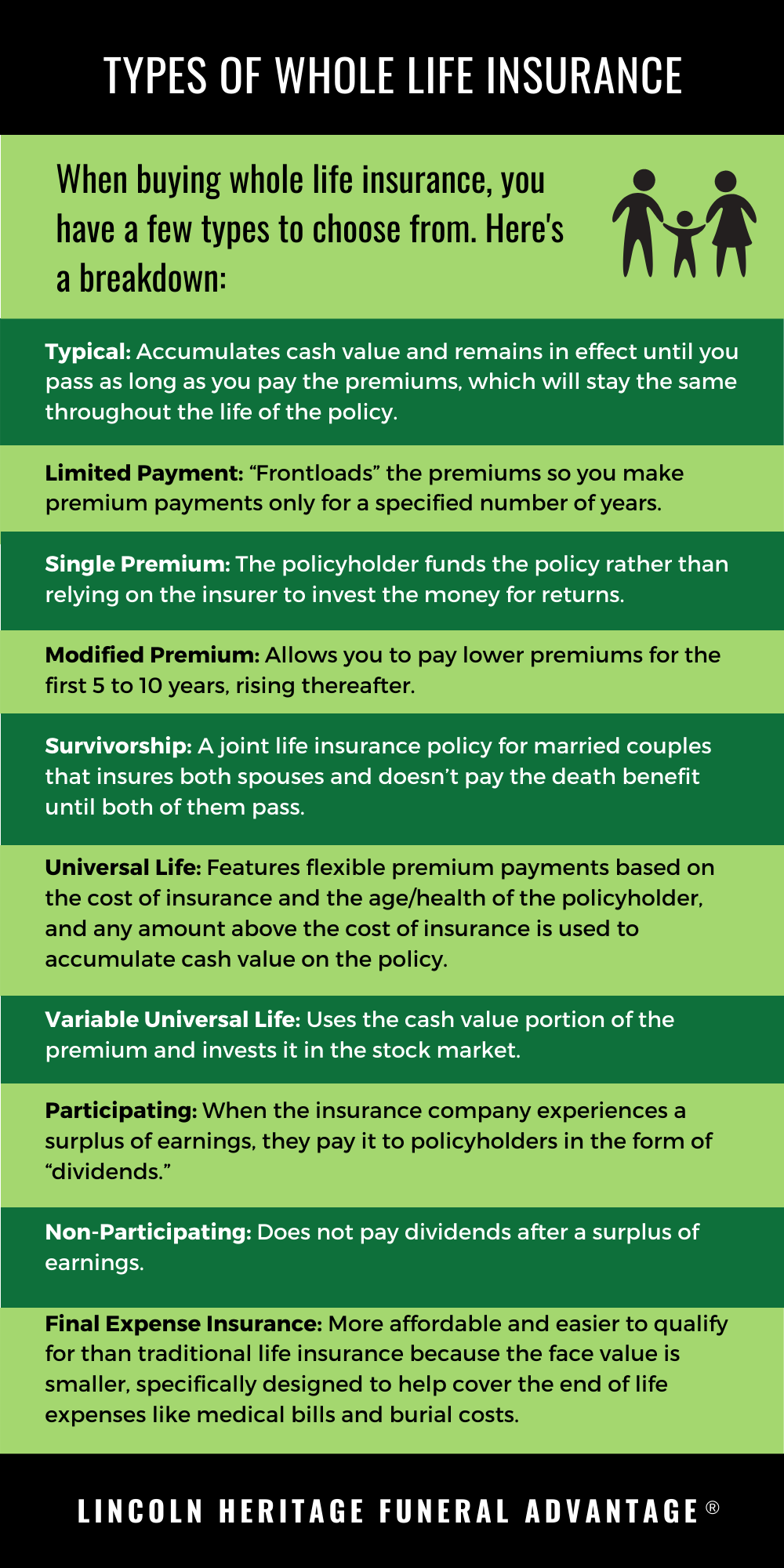

Term life insurance policies have two different. It usually develops cash value by the end of the third policy year. Insuranceopedia Explains Whole Life Insurance.

A type of life insurance with a limited coverage period. Survivorship life insurance differs in that it is a policy that is written on two lives. It is also known as ordinary life insurance.

When endowment occurs in a straight whole life policy. Compare Find the Best Policy For You Save. The goal of a permanent policy is to have life insurance in place for the rest of your life.

In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term. Straight life insurance is a type of permanent life insurance. An annuity provides an accumulation of funds then liquidated payments over time.

Term life insurance covers you for a specific number of years usually 10 20 or 30 years while whole life insurance covers you for life as long as you keep up with your premiums. If X wants to buy 50000 worth of permanent protection on hisher spouse and 25000 worth of 10-year. If you have a short-term life insurance need term life.

The face value of the policy is paid to the insured at age 100. It has the lowest annual premium of the three types of. A term policy is designed for short-term needs.

Straight life insurance can be used as a financial planning tool. Comparing Different Term Plans. Ad Compare the Best Life Insurance Providers.

International Risk Management Institute Inc. Its premium steadily decreases over time in response to its. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

5 Best Rated Term Life Insurance 2021. Traditional whole life insurance is good for the lifetime of. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart. Reviews Trusted by 45000000. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the.

Credit Life insurance is. Because whole life insurance offers permanent coverage or coverage during the policyholders entire life the premium is. As with all whole life.

However both insureds must die before a death benefit is paid - in other words only after the death of the. A whole life policy in which premiums are payable as long as the insured lives. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

What type of premium is charged on a straight life policy. It is meant for long-term goals and not short-term needs. Straight life insurance is.

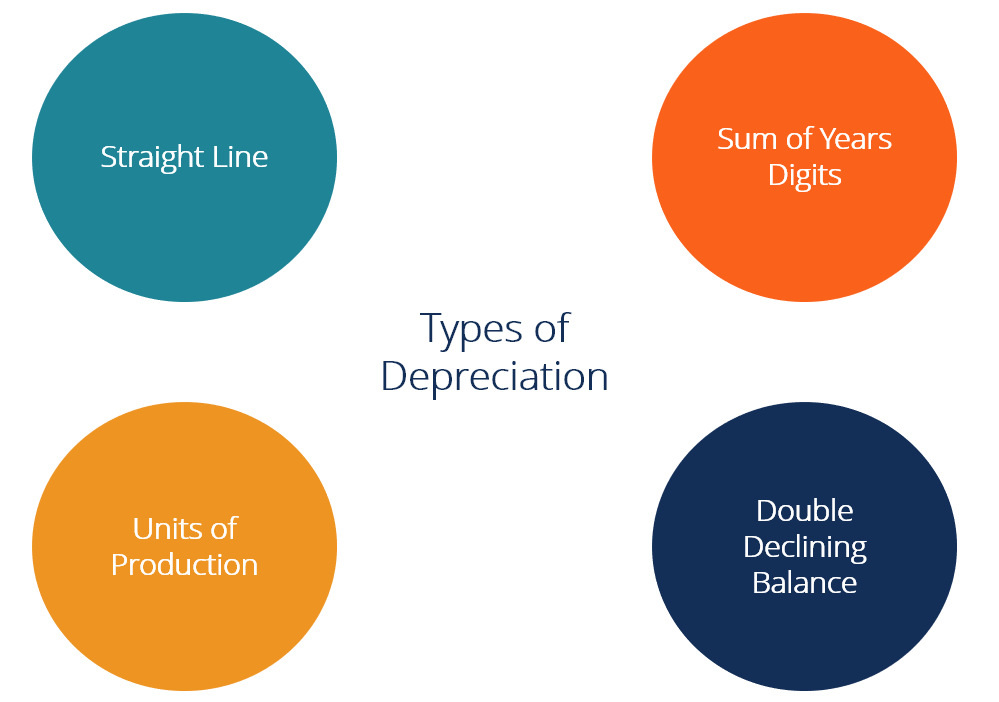

Straight Line Depreciation Formula Guide To Calculate Depreciation

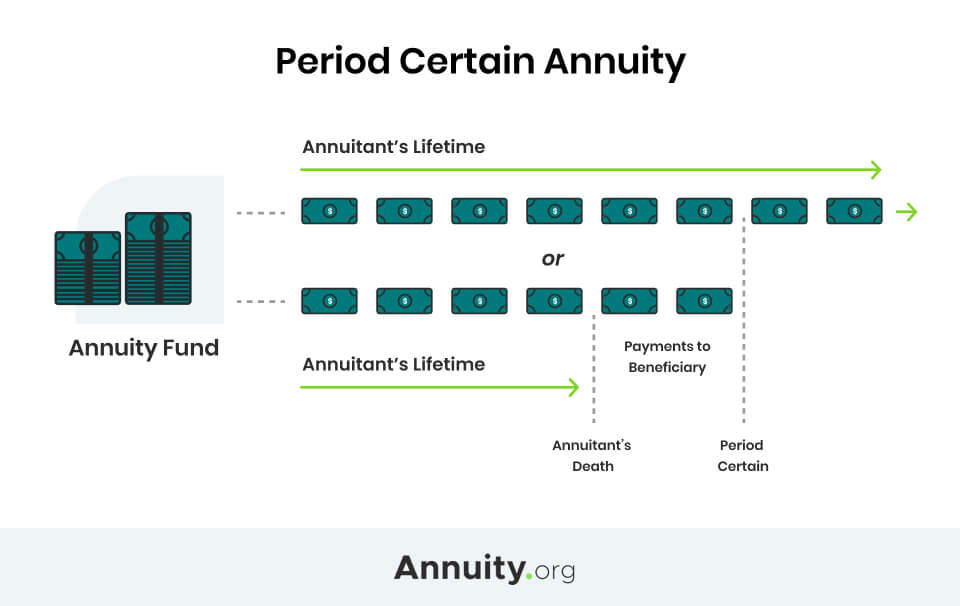

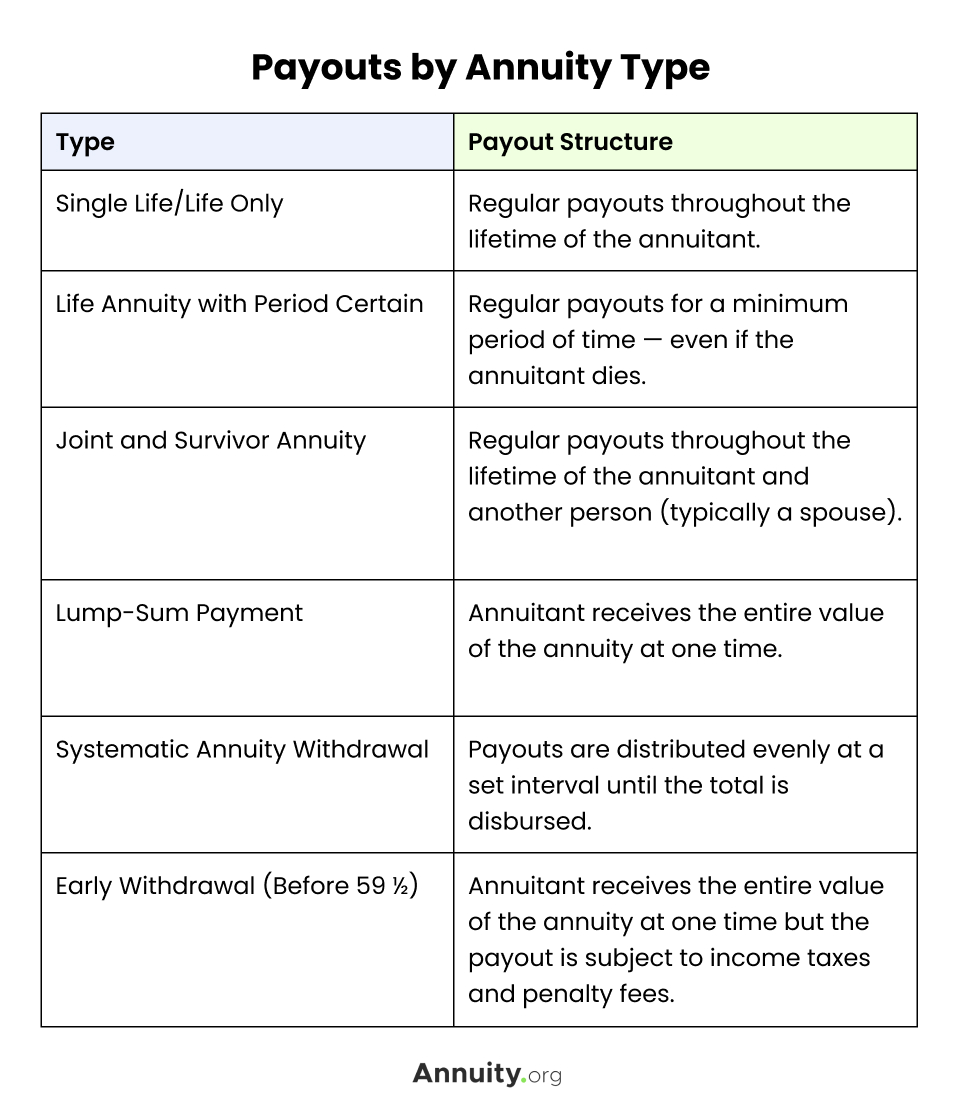

Annuity Payout Options Immediate Vs Deferred Annuities

How Does Life Insurance Work The Process Overview

Straight Line Depreciation Formula Guide To Calculate Depreciation

Super Straight Meaning Trolls Started Transphobic Social Campaign

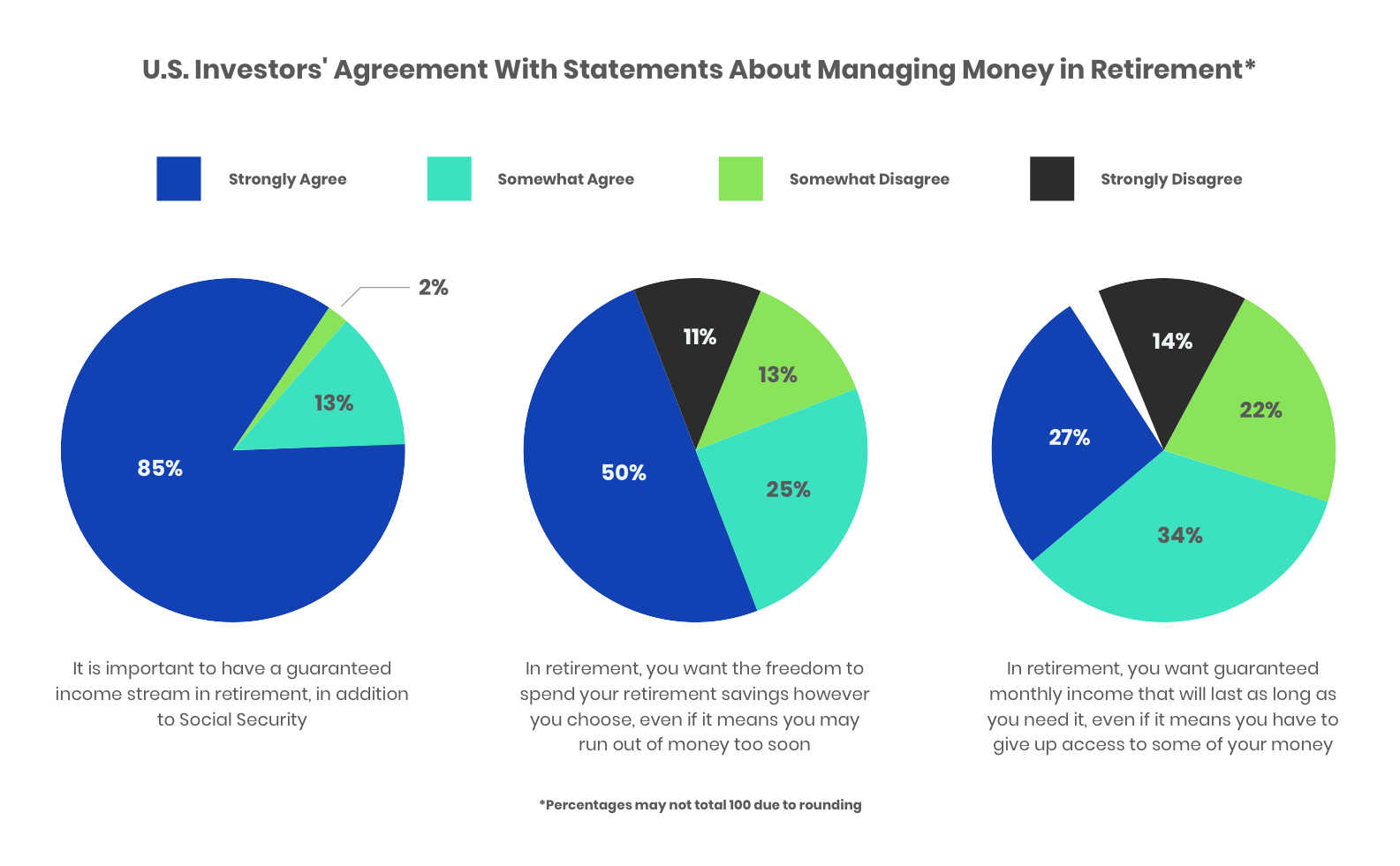

Life Insurance Facts And Statistics 2022 Bankrate

Period Certain Annuity What It Is Benefits And Drawbacks

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Annuity Payout Options Immediate Vs Deferred Annuities

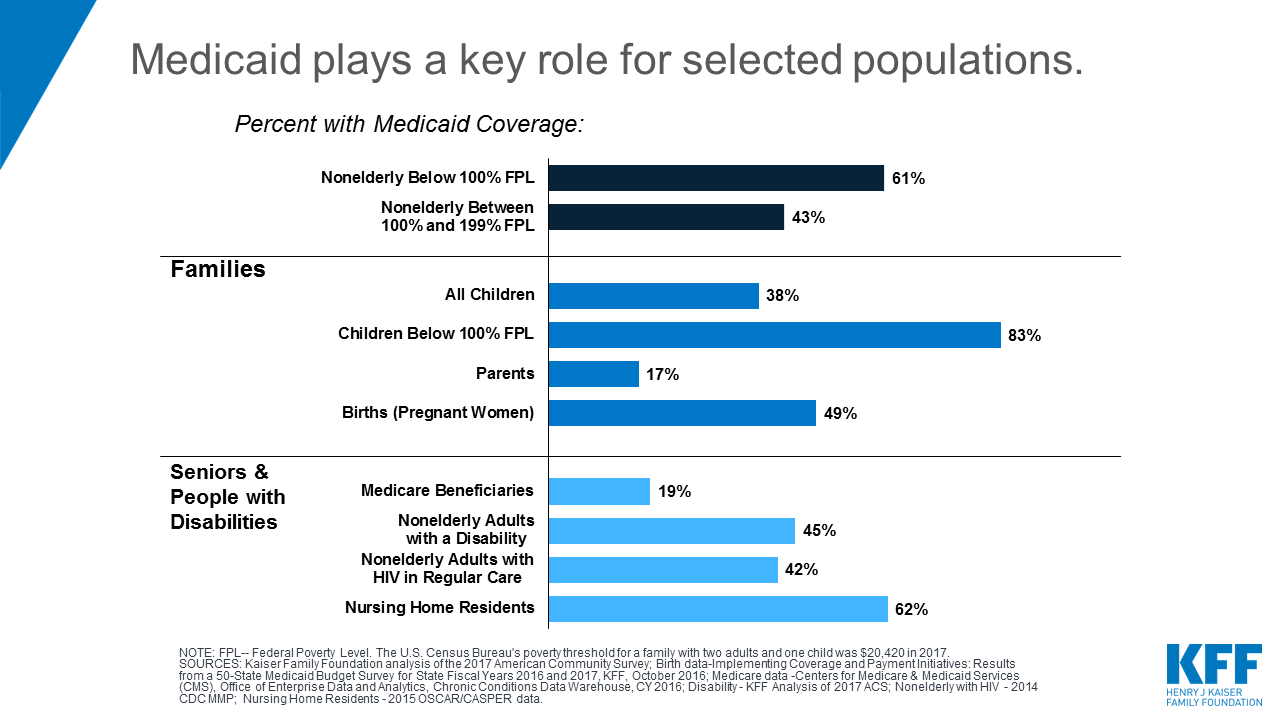

10 Things To Know About Medicaid Setting The Facts Straight Kff

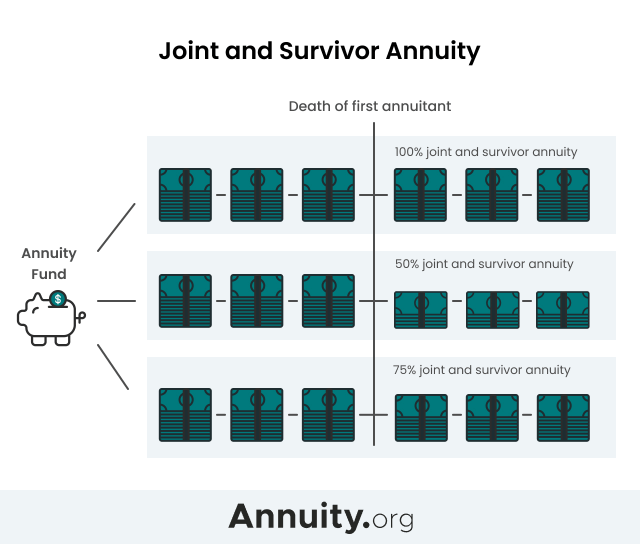

Joint And Survivor Annuity The Benefits And Disadvantages

Depreciation Methods 4 Types Of Depreciation You Must Know

What Is Whole Life Insurance Cost Types Faqs

/What-is-heteronormativity-5191883-FINAL-0c8f5100dbe04694a6fe1fbba052748f.png)